Apolonia Capital is a boutique financial advisory firm led by sovereign advisors and investment banking veterans.

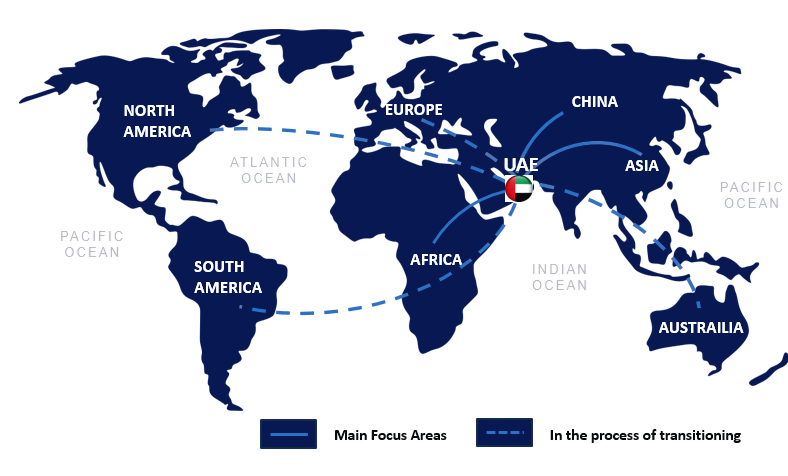

We enable sovereigns, institutions, and families to execute cross-border deals with precision and influence.

Apolonia Capital is a boutique financial advisory firm led by sovereign advisors and investment banking veterans.

We enable sovereigns, institutions, and families to execute cross-border deals with precision and influence.

As a leading financial advisory firm, Apolonia Capital excels in providing expert guidance in mergers and acquisitions, capital raising, and strategic advisory. Our experienced team is dedicated to helping clients navigate complex financial landscapes with tailored solutions that drive growth and achieve business objectives.

Merger & Acquisition

Capital Raising

Sovereign Deals

Royal Families

Asia-Pacific Institutions

Through licensed partners

Apolonia's Team Combined Credentials

Our Services

At Apolonia Capital, we pride ourselves on delivering top-tier financial advisory services tailored to the unique needs of each client.

Our Approach

At Apolonia Capital, we believe that successful financial advisory is built on four key pillars:

Our team brings decades of combined experience across various sectors.

We take the time to understand your unique challenges, goals, & vision.

In a rapidly evolving financial landscape, we stay ahead of the curve.

We view ourselves as an extension of your team.

Delivering Strategic Financial Solutions

Understanding your current situation and objectives.

Conducting thorough research and analysis of your business and relevant market factors.

Our team brings decades of combined experience across various sectors.

Understanding your current situation and objectives.

Continuously assessing performance and making necessary adjustments.